Creative Health Care Deductions

Health Savings Account (HSA)

Save Money on Health Insurance Costs While Providing Dental, Eye Care, and More with an HSA

Health Savings Accounts (HSAs) are a significantly underutilized tool by health insurance agents when trying to trim health insurance costs for the small employer.

What is an HSA?

An HSA is a separate account set up in conjunction with your company’s health insurance account that enables the employer or employee to contribute money tax-deferred into a savings account to be used at a later time for a variety of health care costs. (Individuals or those who are self-employed can also purchase HSAs)

What can the HSA money be used for?

The money in an HSA can be used to pay an employee’s deductible and co-pays as well as a number of other health insurance costs not normally covered under traditional small employer health insurance plans. Those expenses not normally covered include: contact lenses, prescriptive glasses, dental treatments, orthodontics, drugs, psychiatrists, and the list goes on and on.

Why use an HSA?

There are three main reasons.

- There is a great possibility you can lower your health insurance premiums (sometimes in excess of 50%).

- Your business can offer added benefits to your employees without any extra out-of-pocket costs.

- If the money contributed to the HSA is not used during a calendar year, that money not only rolls for use during a later year but, at age 65, the money can be used as a supplemental retirement income (like an IRA).

How Does an HSA Work to Save Your Business Money?

Today, most businesses have health insurance deductibles of $500 per person. That means the maximum annual exposure to the employee is $500 (plus any co-pays). Based on the health of your business’s employees and the deductible, a health insurance company quotes your business as both a family and an individual premium. Those premiums are getting higher and higher in a very difficult health insurance market.

HSAs are based on the concept of high deductibles. That’s right high deductibles. In 2019 Employee-only deductibles must be between $1,350 and $6,750 a year and family deductibles must be $2,700-$13,500. The key is that with the higher deductibles, the employee and family insurance premiums will be significantly lower.

The first impression of a change to a high deductible plan is negative by the employee and employer. No one wants to be responsible for that extra high deductible. The key to success with a high deductible plan is through the incorporation of the HSA. An employer or employee can fund the HSA to cover the extra cost of the deductible.

Why Would Anyone Entertain Such Madness?

Long-term savings and extra benefits. Right now, once health insurance premiums are paid, the money will never come back to the employer or employee. With an HSA, if the money is not used inside the HSA, the employee gets to keep the money as his/her own for future medical expenses. Once enough money is deferred into the HSA to cover the deductible, an employer can choose to stop contributing to the HSA, thereby significantly decreasing the annual health insurance/HSA expenses. An example is the best way to show the long-term benefits of an HSA.

Example:

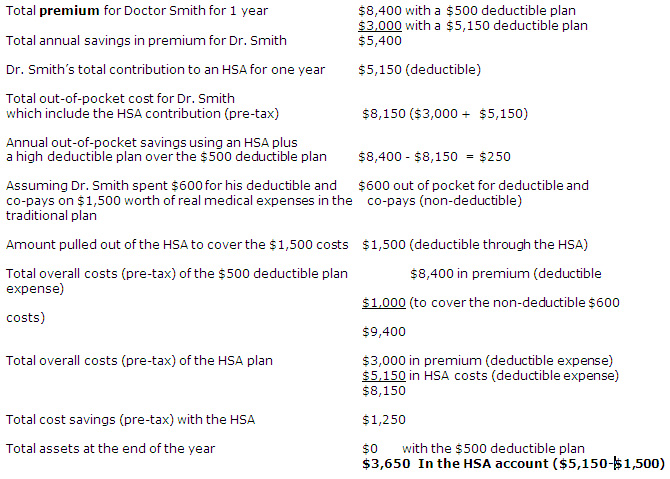

Assume with a small business health plan the family premium is $700 a month with a $500 deductible. Also, assume that a family premium with a $5,150 deductible is $250 a month. Assume the family premium is for a doctor/owner of a medical practice.

In the above example, three good things happen.

- The total out-of-pocket expenses for the health insurance and the HSA costs are $250 a year lower than the traditional $500 deductible non-HSA plan.

- Dr. Smith’s family only used $1,500 of the $5,150 in the HSA account, and $3,650 stays in the HSA account that is owned by Dr. Smith.

- Just as important is the fact that, IF the physician’s family is relatively healthy in years to come, the money accumulated in the HSA can roll to the next year, thereby cutting the next year’s out-of-pocket costs of the doctor. The doctor could also continue to fund the HSA at $5,150 a year to stockpile money in the HSA for other medical expenses (orthodontics) or for supplemental retirement benefits and, ultimately, that money can be used in retirement (like an IRA).

If the above example is a real-world example, then why don’t all businesses have HSA accounts in conjunction with their group health plans? There are three main reasons.

- Most insurance agents despise the concept of HSAs. When an agent lowers the premium for a client, the agent takes a significant pay cut. The agent makes nothing on money contributed to the HSA.

- FEAR. Most employers don’t have the guts to implement a plan that raises the employee’s deductibles to between $1,350 to $6,750 for an individual (2019 limits). If fully explained to the employees, the employees should jump at the chance to have an HSA implemented in their business. Why? The business is going to cover the difference between the old deductible and new deductible; and if at the end of the year the employee did not need to use the money in the HSA for deductibles, then that money becomes the employees.

- Businesses with several sick employees (employees who always hit their deductible and then some every year) will have a hard time making the HSA concept cost-effective due to prohibitively high insurance premiums and the fact that the HSA account will be drained every year for those sick employees.

This material does not give all the details behind implementing an HSA, but the material should make you aware of other options out there that your business should look at when trying to save money on a very difficult topic.