Learn How We Work with Our Clients

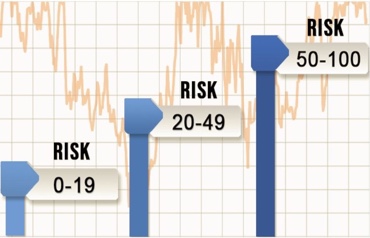

FIND YOUR PERSONAL RISK SCORE

Most people have no idea what their true appetite for “risk” is when it comes to growing wealth for retirement. We use the industry’s most accurate risk assessment software to help clients determine their personal Risk Score. If you want to know your Risk Score on a scale from 1-100, click on the button below.

QUICK RISK SCORE APP

Do you wonder how risky your investments are? Find out by using our Investment Risk Quick Score App!

Growing Wealth for Retirement Begins with Risk Management

At Swiss American Financial Solutions, we have put together a multi-disciplinary group of professionals who have a goal to help grow and protect your money. From asset protection to college planning, retirement, and estate planning, we offer a wide variety of services.

Managing Risk to Reach Your Retirement Goals

WHY CHOOSE US?

Our firm believes strongly in putting clients’ needs first. That may seem obvious, but when working with new clients, it is not always apparent that the previous advisor’s advice was what’s best for them.

Our firm prides itself in its knowledge of a broad spectrum of concepts and products. Even so, we know it is impossible for one person or one firm to know it all. That is why we have strategic alliances with some of the top law firms in the country as well as other top experts in the finance and insurance fields.

Our goal is to be “the” place a client can turn to get answers/help on asset protection, income, estate, and capital gains tax reduction, growing wealth in the least risky manner possible, estate planning, business/corporate planning issues, and much more.

We hope you enjoy our website and find time to both read various parts of the site as well as watch several of the educational presentations.

MORE INFORMATION

What is Asset Protection?

Most asset protection “gurus” believe asset protection revolves around helping clients who have money protect that money from your “typical” creditor from a negligence suit.

While that’s important, such gurus forget that the #1 creditor clients have every year is the IRS (taxes). Also, people are much more likely to lose money in the stock market in any given year than to be sued for negligence. The goal of a “good” asset protection plan is to make sure “all” of your assets are protected from “all” creditors. This is the specialty of our firm as you will learn when you review our site. To view a brief video presentation on asset protection or to learn more click here.

Predicting The Future

Do you believe the stock market is going to average double-digit returns anytime soon? Do you worry about your money going backward in a Bear market? Learn More…

What is the “best” way to grow your wealth for retirement? Is it through tax-deferred tools like 401(k) plans or IRAs? Is it by investing in stocks, mutual funds, index funds, cash value life insurance, annuities, bonds, etc.?

How much risk should you take to reach your financial goals? Our answer is that clients should take the least amount of risk necessary to reach their financial goals (unfortunately most Americans do not take this approach and pay the consequences when the stock market tanks).

This website discusses many unique wealth-building tools so readers can educate themselves and make “informed” decisions about the “best” way to grow their wealth.

Protecting Your Wealth From Stock Market Losses With Fixed Indexed Annuities (FIAs)

What you are about to learn will be very exciting to you.

For readers who lost 40%+ when the stock market crashed in 2000-2002 and 40-50-60% when it crashed in 2007-March of 2009, this material will be a real eye-opener.

This material covers Fixed Indexed Annuities (FIAs) and why you may want to use them as one of your protective wealth-building/retirement tools.

For more information and to learn how you can use FIAs to protect and grow your wealth, please click here.

KEEP YOUR MONEY SAFE WHILE GROWING YOUR PRINCIPAL